WELCOME TO THE BROOKHAVEN CITY GUIDE

Here's All You Need to Know About

Living In Brookhaven ...

Brookhaven Market Updates

How Marketing And Innovation Will Get YOU More Money And The Best Terms When Selling Your Home With Andora Realty Group!

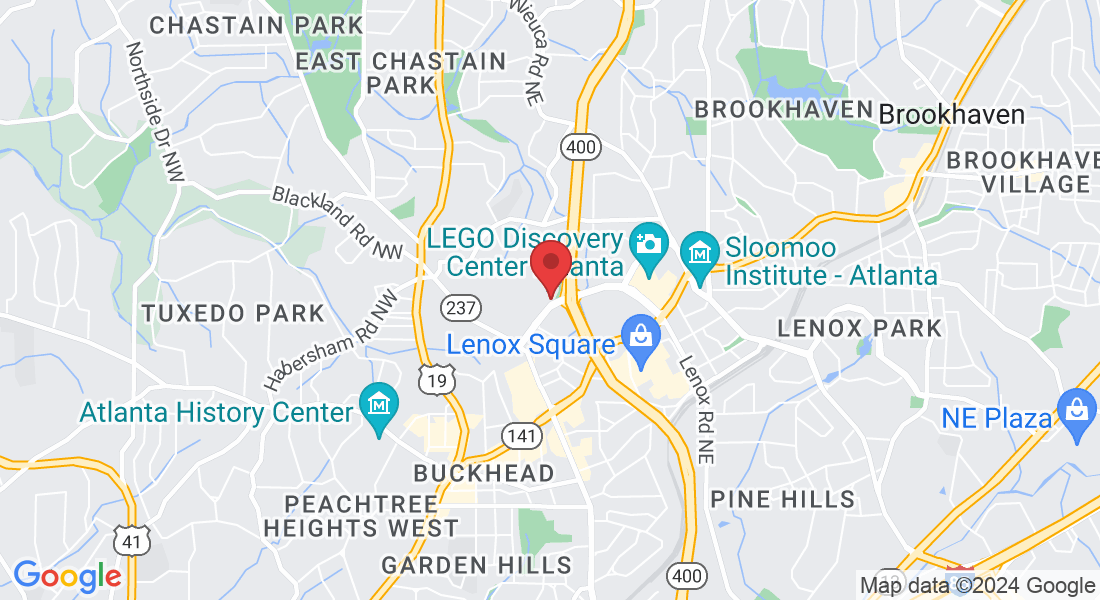

Eager to sell your current home or find your dream residence in Brookhaven? Whether you're drawn to sleek modern designs, cozy farmhouse aesthetics, or classic Craftsman styles, Brookhaven offers a variety of options, from condos to townhomes. Discover a vibrant community filled with delightful eateries, shopping destinations, and charming walkable areas. Nestled just inside the perimeter, north of Buckhead, in the esteemed 30319 zip code, Brookhaven is your gateway to Atlanta's fantastic amenities. Let us guide you every step of the way on this exciting journey!

Exclusive Market Updates

Stay ahead with our up-to-the-minute market updates. From the latest listings to price trends, we ensure you have all the information you need to make informed decisions. Brookhaven's real estate landscape is dynamic, and with our expert analysis, you're always in the know.

Market Updates

National Market Update

NAR Market Update

Market Trends

Seller Tips

Community Videos

COMING SOON!

COMING SOON!

Considering Selling?

Selling a home can be an exciting but also challenging experience. If you're planning to sell your Brookhaven home, it's important to be prepared and aware of what to expect throughout the process. This short guide is designed to provide savvy sellers like you with valuable insights and tips to navigate the sale of your Ashford Park property successfully.

DOWNLOAD TO ACCESS:

The Ultimate Guide to Selling Your Home

DOWNLOAD TO ACCESS:

DOWNLOAD TO ACCESS:

Preparing for a possible move this summer? Click below to check out our moving checklist to get your whole house ready for the next home!

Want to know what is happening throughout Brookhaven Now? Click below for a full live schedule of local events around town!

Discover the Charm of Living in Brookhaven

Brookhaven's unique neighborhoods offer homes that fit every lifestyle. From the family-friendly vibe of Brookhaven Heights to the prestige of Historic Brookhaven, each area provides distinct living experiences. Browse all available listings and find the charm and appeal that awaits in Brookhaven's diverse communities.

Brookhaven offers outstanding educational opportunities, from nurturing preschools to top-rated elementary, middle, and high schools. This community is committed to excellence with innovative learning environments and programs emphasizing STEM, the arts, and languages. See how Brookhaven's educational landscape supports every student's aspirations and paves the way for bright futures.

Brookhaven is full of activity, culture, and community spirit, with a diverse dining scene and endless entertainment. Enjoy spring festivals celebrating arts and local cuisine, fall fairs, and outdoor adventures in family-friendly parks. Brookhaven's dining options include cozy cafés, buzzing bistros, and fine dining experiences, catering to every palate.

Experience Brookhaven's active lifestyle with public pools, tennis courts, private clubs, and fitness facilities. Enjoy endless opportunities for sport, leisure, and community connections. Stay updated on Brookhaven's recreational scene and find your perfect spot for activity and relaxation.

WELCOME TO THE VIRTUAL HOME SELLER SEMINAR FOR BROOKHAVEN

If you're either thinking about selling your Brookhaven home or already made the decision but you still have questions or concerns regarding the process, price or anything else - let me tell you:

You're in the right place.

This free seller seminar is giving you the exact step by step blueprint on everything you need so you can get clarity on everything A-Z and guide to you make the best decision in purchasing your new home.

You will learn about timelines and timing, marketing your home, pricing your home, negotiations, and so much more.

Take a look around and let us know how we can help you.

Mellanda Reese | Broker & Owner

Andora Realty Group

License # 334081

Discover How To Sell Your Home Faster and Get Top Dollar!

Enjoy the latest & most up-to-date marketing & sales tactics to sell your home fast, for top dollar.

"Will your home pass the test before going to market?"

Learn how to sell your home for top dollar right now

You may need to make a few changes before selling

"Let's talk about the timelines before listing a home with us."

What you should expect when getting your home ready to sell

How to maximize the return on your investment

"How quickly will my home sell? This is a common question we get."

Learn about the market climate and absorption rates

The market climate will determine how quickly your home will sell

"The importance of marketing your home properly."

Digital marketing exposes your property to the masses

Negotiation will be key in selling you home

Pricing your home is not as easy as checking Zillow

"How do you determine what your house is worth?"

Pricing your home right

Factors to consider are size, condition, location, marketing, and negotiating

Underpricing and overpricing your home will cause you to lose money

"Should I use Zillow as an accurate evaluation of my home’s value?"

Zillow is an algorithm based on public data

Zillow has never seen the inside of your home and it’s a computer

Zillow comes up with the value based upon what your neighbors are selling for

To disclose or not to disclose

This is vital to ensure that you are safe during and after the sale

Over-disclosure is better than under-disclosure

"How do you know if you should accept the offer you just got?"

What if you don't receive the amount of offers you were hoping for?

What happens if we have more than one offer?

"Are we heading into a recession and is now a good time to buy and sell?"

If you're fearful of selling due to a recession, you may want to think again

Remember, it's all relative

"How to negotiate like a master to make sure you get the most out of your home?"

How to get top dollar when selling

Walking away with the most amount of money in your pocket

"Should you get inspections done prior to listing my home?"

The advantages of having inspections done prior to listing

Saves you time and money

How to make a good first impression

How to get maximum exposure and top dollar

There are simple tricks that can save you money and maximize the return on your investment at the same time

NO NO NO!

The goal is for your home to be seen by the masses

Then, to get the highest and best price and terms for your home

"When the final sale is contingent on certain criteria being met."

This criteria, or contingencies, typically fall under four major categories: appraisal, loan approval, inspections and reports & disclosures

"Now we're in contract prior to contingencies being removed. Now we're in business."

The buyer now will secure their loan, have their inspections on the property, and review all of the reports and disclosures

Mellanda Reese | Broker & Owner

License # 334081

Meet Mellanda Reese

Mellanda Reese, a seasoned real estate professional with over 23 years of industry experience, is the driving force behind The Andora Group, a thriving brokerage serving the Atlanta-metro area.

Formerly the CEO of a short sale facilitation company, Mellanda transformed her business model to meet evolving homeowner needs.

Drawing from her background with Fortune 500 companies and lenders, Mellanda has refined her negotiation skills, navigating challenges with ease.

Under her leadership, The Andora Group prioritizes integrity, trust, and excellence, setting new standards for client satisfaction and industry leadership. Whether buying, selling, or leasing, Mellanda's personalized approach makes The Andora Realty Group the ultimate choice for real estate needs.

SUPPORT OUR SMALL BUSINESSES

Get Featured on Our Platform!

Do you run a small business in our community? We'd love to help spotlight your work and share your story with our audience. If you're interested in being featured, please reach out to us! Let's work together to support and grow our local business ecosystem.

Visit our blog for more real estate tip, home tips, and local

information!

Unlocking the Golden Ticket of Homeownership: How Equity Can Transform Your Next Move in Atlanta

“Home equity is more than just a financial tool - it's a gateway to achieving your dreams and securing your future.” - Mellanda Reese

Understanding Home Equity for Homeowners in Atlanta, GA

For many homeowners in Atlanta, GA, home equity can feel like a golden ticket. This powerful financial tool represents the portion of your property that you truly own and can be leveraged for a variety of important purposes. Whether you're looking to renovate your home, consolidate debt, or finance a major purchase, understanding home equity is key. Let’s explore what home equity is, its benefits, and how you can make the most of it.

What is Home Equity?

Home equity is simply the difference between your home's current market value and the amount you still owe on your mortgage. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, your equity amounts to $100,000. This equity increases as you pay down your mortgage and as your home’s value appreciates.

How Home Equity Builds Over Time

Home equity grows through two main factors: paying down your mortgage and home appreciation. With each mortgage payment, you reduce the principal balance of your loan, thereby increasing your equity. Additionally, as home values in Atlanta rise, so does the market value of your property, further boosting your equity.

Benefits of Building Home Equity

Building home equity has numerous financial benefits. You can tap into this equity through loans or lines of credit for home improvements, paying off high-interest debt, funding education, or even investing in additional properties. Moreover, having significant equity can act as a financial cushion in times of need.

Leveraging Home Equity: Options for Atlanta Homeowners

If you're a homeowner in Atlanta, GA, you have several options to tap into your home equity. Understanding these options can help you make smart financial decisions that align with your goals.

Home Equity Loans

A home equity loan allows you to borrow a lump sum of money against your home’s equity. This type of loan typically comes with a fixed interest rate and repayment term, making it a good option for significant expenses like home renovations or debt consolidation.

Home Equity Lines of Credit (HELOC)

A HELOC works like a credit card but uses your home as collateral. You can draw from this revolving line of credit as needed, up to a predetermined limit. HELOCs usually have variable interest rates, making them suitable for ongoing or unpredictable expenses.

Cash-Out Refinancing

Cash-out refinancing involves refinancing your existing mortgage for a higher amount than you currently owe, with the difference given to you in cash. This option is beneficial if you want to take advantage of lower interest rates while accessing your home equity.

Maximizing Home Equity in Atlanta, GA

To maximize your home equity, consider these strategies specifically tailored for Atlanta homeowners.

Regular Mortgage Payments

Making consistent mortgage payments is the simplest way to build home equity. As you pay down your loan balance, your equity grows.

Home Improvements

Investing in home improvements can increase your property’s value. Strategic upgrades, such as modernizing the kitchen or adding energy-efficient windows, can significantly enhance your home’s market value and, in turn, your equity.

Market Trends

Keep an eye on the real estate market trends in Atlanta. Understanding when property values are likely to rise can help you make timely decisions to maximize your equity.

The Golden Ticket of Homeownership

Home equity is often considered the "golden ticket" of homeownership, especially for those who have been in their homes for several years. As I explain to my clients at Andora Realty Group, your equity can be your golden ticket to your next move. It’s the value you’ve built up in your home over the years, both from paying down your mortgage and from your home’s appreciation.

Building Significant Equity

Many homeowners in the United States have built up significant equity, either by fully paying off their mortgage or by paying down enough combined with home appreciation to have at least 50% equity. According to CoreLogic, the average homeowner with a mortgage has around $298,000 built up in equity.

Utilizing Your Equity

So, what can you do with this much equity? For starters, if you’re planning a move, selling your home can provide a larger down payment on your next one, which means borrowing less from the bank. In some instances, you may have enough equity to pay all cash on your next purchase, which can be incredibly advantageous.

Enhancing Affordability

Having equity in your home can make your move possible when affordability is tight. Additionally, the more equity you have, the more options you have to buy down your interest rate and secure a more affordable payment.

FAQ

How does home equity impact my net worth?

Home equity is a significant component of your net worth. It represents the value of your ownership stake in your property and can be a substantial asset.

What are the risks of tapping into home equity?

The primary risk of using home equity is that your home serves as collateral. If you're unable to make payments on a home equity loan or HELOC, you could risk foreclosure.

Can I use home equity to buy another property in Atlanta?

Yes, you can use home equity to finance the purchase of another property. This strategy can be particularly effective if you're looking to invest in rental properties or vacation homes.

How do I determine the current value of my home?

You can determine your home's current value through a professional appraisal, online real estate platforms, or by consulting with a local real estate agent.

Are there tax benefits to using home equity?

Interest paid on home equity loans or HELOCs may be tax-deductible if the funds are used for home improvements. Consult a tax professional to understand the specific benefits in your situation.

Understanding and managing home equity effectively can unlock significant financial potential for homeowners in Atlanta, GA. Whether you’re looking to renovate, invest, or simply build your wealth, leveraging home equity can be a smart strategy. For more personalized advice and to understand your home's current market value, reach out to me, Mellanda Reese at Andora Realty Group.

Want to be sure you don't miss out on any tips & Brookhaven real estate market updates?

Have them delivered to your inbox

Subscribe to the monthly digital newsletter below

WHAT PEOPLE ARE SAYING ABOUT ANDORA REALTY GROUP

"The Andora Group Is The Absolute Best Way To Go For A Smooth Home Sale!"

"Working with Mellanda has been a pleasure. She is professional, caring, and knowledgeable. She really cared about making sure we were taken care of through the entire process and we still have dinner with her once a month. She has become a part of our family."

-Norm & Jane Y

"I Could Go On For

Pages Expressing Our Gratitude!"

"Working with Mellanda was a true blessing. Because of Mellanda’s experience, knowledge, wisdom, patience, negotiating power and compassion, we were effectively transitioned out of our home! This happened in a relatively short period of time. I could go on for pages expressing our gratitude and testimony. I trust Mellanda to sell and buy a home for my family anytime."

-Andrea C.

"Thanks To Her

Expertise We Received Multiple Full Price Offers!!"

"Mellanda Reese is an outstanding realtor!

She is completely committed to delivering stellar customer service. She responds promptly to and truly acts in the best interests of her clients. We highly recommend Mellanda to anyone looking for an agent whose knowledge and negotiating skills are second to none."